As MDCC bank pledges Rs 852 crore to 26 housing societies, CM Fadnavis mulling a policy on self-redevelopment; MHADA too jumps into the fray.

On the third floor of the Mumbai Bank Bhavan

at Fort, a small crowd is gathered outside the cabins of housing activist Chandrashekhar Prabhu who works there in an advisory capacity, and the chairperson of Mumbai District Central Cooperative

(MDCC) Bank Praveen Darekar.

Both Prabhu and Darekar who is also a BJP MLC are votaries of the fast-catching trend of housing societies going in for self-redevelopment. At present, 650 societies have applied to MDCC for self-redevelopment.

“Why do societies go to the builder-developer? Because he takes care of all the permissions required for construction and has the capital to do the project. In self-development, the Society appoints the contractor who gets all the permissions and our bank takes care of the capital,” explains Darekar.

At present MDCC is the only bank in Mumbai where societies can be funded for self-redevelopment.

“We have already pre-sanctioned Rs 777 crore to 19 societies, and seven more societies have got the final sanctions for Rs 75 crore.

So, we have pledged a total of Rs 852 crore to 26 societies so far. Six of these societies have already begun the process of reconstruction,” says Uday Dalvi, MDCC’s key nodal officer for self- development.

Residents of Vijay Palace in Malad had to move out of their building when the celing of a flat collapsed

The bank also offers a two-year moratorium on the loan. “Though interest on the loan is calculated for this period, we don’t take it until the end of two years. Meanwhile, societies are able to sell the saleable flats and they are able pay the loan with interest. So, the society does not have to pay anything from its pocket initially,” says Dalvi, who has held over 700 meetings with societies across Mumbai over the last three years to promote self development.

Sandeep Ghandat, son of veteran politician Sitaram Ghandat and a member of MDCC’s self-redevelopment committee which meets every week, says the MDCC team also works out a break-even rate at which the free sale flats could be sold. “If the free sale flats are sold at this breakeven rate, then the bank recovers its investment. So, society members are already aware that the flat is available say at the actual cost of Rs 24,000 per sq ft. In builder-driven model, in contrast, the builder would sell the same flat for Rs 35,000 psf to earn profits,” he says.

Buoyed by the response Darekar has is mooting a consortium of banks work together on financing the self-devlopment projects. The Thane District Bank, and the Pune District Bank have so far given their consent, he says. “There are 100 urban banks in Mumbai, and we will select 10 of these banks and invite them to join the consortium and raise a corpus of Rs 5000 crore to fund these projects over long term,” he says.

Under the Maharashtra Cooperative Housing Societies Act

, all societies have to be members of their area’s district cooperative bank and park society funds there. MDCCs policy on self-redevelopment came about as a response to the needs of its client societies.

The MDCC also has a vetted-panel of architects, building contractors, solicitors, chartered accountants who can provide their expert services to societies. One of the leading contractors on this is BE Billimoria and Co Ltd. Its general manager MD Chavan says: “We are not really coming in as a developer but as a consortium leader to manage the planning, engineering, construction and finances in coordination with the bank and societies. For us, it is just carrying out construction work in return for a professional fee. We drive the project, but not with the developer’s margin.”

“In self-redevelopment, the construction quality is the same for the original members and for the saleable component. This is different from the builder-developer who often have different quality standards for rehab and saleable components,” says Chavan.

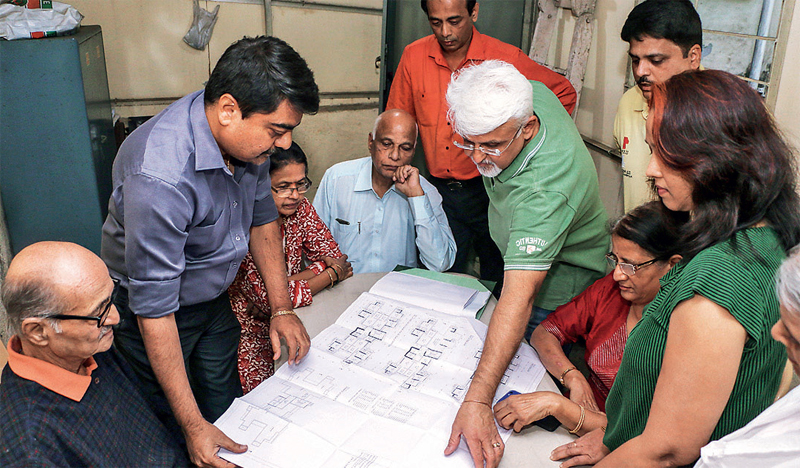

A meeting in progress at Shantaprabha in Goregaon to study the self-redevelopment plans

Similarly, there are new companies like Wedevelopment which have stepped in to provide end-to-end services from obtaining all permissions including the Occupancy Certificate right up to the time of possession. “Once the project goes live, we do daily and weekly briefings to the Society managing committee on the progress,” says Pranay Goyal, director, Wedevelopment and the son of prominent Borivali-based developer Satyendra Goyal of the Goyal Group. Wedevelopment began first two self development projects for Suma Sam or Harmony CHS and Jayakung CHS in Borivali’s IC Colony last week.

Like private housing societies, self-redevelopment is also catching up at old MHADA projects. On chief minister Devendra Fadnavis’s instructions, MHADA has been giving priority to self-redevelopment and has set up a special cell to facilitate proposals. “We are giving clearances within seven days. We have got about 140 proposals from societies so far, and five are in final stages of approval of which three have been given offer letters,” says MHADA Vice President and Chief Executive Officer Milind Mhaiskar. He added that MHADA has also relaxed the rules for premium payments and allows societies to pay premium in instalments.

One of the biggest MHADA societies to opt for self-redevelopment is the MHADA colony in Akurli in Kandivali. “We are 40 MHADA societies with 1186 rooms spread over a 22 acre area. We have three categories – Lower Income Group, Middle Income Group and Higher Income Group. The 250 sq ft homes and will get 625 sq ft carpet area, the 300 sq ft flats will get 750 sq ft, and 400 sq ft will get around 1000 sq ft,” says Datta Salvi, one of the two chief promoters of the cluster.

BE Billimoria and Co Ltd has been roped in as a contractor. “The project has about 40 lakh sq ft construction area. We are still working out the exact details of the project, but approximately five societies will make one tower, and we are looking at 10 towers of 20 floors each with all the modern amenities. If we go for 30 floors, the society will be able to get a higher price for the saleable flats,” says Chavan of Billimoria and Co Ltd.

Darekar says he has sought a meeting with Chief Minister Devendra Fadnavis soon to discuss if self-redevelopment could be made into a state policy where state could provide incentives. “We will present this Kandivali MHADA cluster as an example before the CM. If the state provides incentives like 0.5 to 1 extra FSI, staggered premium payments in instalments, single window clearances, it will benefit people and give a strong momentum to the self development movement,” says Darekar.

Milind Mahadik, secretary of Purvarang Society in Navghar, Mulund East said his Society surveyed other developer-driven redevelopment projects in Mulund and found that 80 per cent of them had failed to rise beyond the plinth level over several years, and that’s when they looked at self redevelopment option.

Saptarishi in Borivili was the first society to take a loan from MDCC bank

“We applied for a loan through the Mumbai Bank scheme, and the bank has sanctioned Rs 15 crore. Our existing flats are of 400 sq ft each, and we will get 800 sq ft each when the project is complete. All this was possible because of the team work of 15 members who worked on this,” said Milind Mahadik, secretary of Purvarang.

Mahadik said the original seven storey structure will be demolished and redeveloped into a 20-storey building with three floors of podium parking. “The saleable component will be of 60 flats. We will give first preference to blood relations of our members when we sell these flats, and then we will sell the rest in the open market. The money from the saleable component will repay the loan amount,” he said.

Mahadik said the biggest advantage of self redevelopment was that the Society managing committee retains control over all aspects of the projects. “Even if we select a contractor and he runs way leaving the work incomplete, we can engage another one and get it completed. We can choose our own amenities,” he said.

65-year-old Gajanan Dongare has been much in demand not just because he runs the Laughter Club in Eksar locality in Borivali, but also because he was the driving force for the self redevelopment of Saptarishi Society, one of the first such societies completed in March 2016.

Dongare narrates how when the building was originally constructed in 1987, the developer cheated and built just one slab despite taking 80 per cent of the money. “I went straight to the crime branch, and he was arrested. I became the Chief Promoter and ensured that the three-storey building came up. Around 2009, the Society felt that it requires some repairs and we floated tenders, but no developers came forward as our area was only 595 sq m. We then approached Mumbai Bank for a repairs loan. They suggested why not a loan for self development and sanctioned Rs 2 crore,” he says.

Dongare said the project, however, faced a lot of problems and the Society had to work through them in a determined manner. “We realised that the Rs 2 crore was insufficient to complete the project. The 17 members in the Society had to raise another Rs 2 crore, The Mumbai Bank supported us a lot. Now, the bank has simplified and put together a smooth process,” Dongare said. In September 2015, the construction was completed and in March 2016, the seven-storey building got the Occupancy Certificate. “We got 30 per cent extra carpet area. We sold 11 flats from the saleable component and paid back the loan. Now societies in the area come to me for advice on self-redevelopment,” he says.

Purvarang in Mulund is one of the five MHADA societies to undertake self-redevelopment

“The benefits of self-redevelopment far outweigh the disadvantages,” says Ajit Thakur, secretary of AjitKumar Society in Goregaon, which is ready six months ahead of schedule. “Since the society manages everything, you will get your house on time, and rent for alternative accommodation for as long as you need. You’re not at the mercy of a builder. You also have control over the plans of the building, the amenities, and you don’t sign off your development rights to a builder who may then put up 20-storied tower without your consent.” Deben Moza, Executive Director and Head of Project Management Services at Knight Frank, India, agrees. “Self-redevelopment puts people in control of deciding what they want and how they want it… I think the right way of going about it is to conduct a feasibility study, so you can [understand the society’s] re-development potential, utilise the extra FSI, or even have a part-commercial, part-residential plan. The additional residential FSI, and the sale price of that, is also something the society can benefit from.”

This is certainly a motivating factor for many societies. The additional FSI, which a developer may have reserved for himself, now gets passed to the society which undertakes its own redevelopment. And the gains can be considerable. The four-storied, 603-sq-mt Vijay Palace, for instance, will be turned into a 12-floor apartment block, and each flat size (currently 357 sq ft), will become at least 500 sq ft. After accommodating its 16 members, there will still be 36 flats left for the society to sell at market rates. At Ajitkumar Society, the previous three-storied structure has now been replaced by a nine-floor block, with each apartment gaining at least a 100 sq feet in size. Shantaprabha, currently a 1,794 sq mt plot, will more than double in size, with flats increasing their carpet area from 550 and 870 sq ft, to 819 and 1,300 sq ft. After allotting flats to its 16 members, the 19-storey highrise will still have 42 flats to be sold at market rate. In fact, most societies bank on such open-market sales to pay off their redevelopment loans.

Not everyone is impressed by this new trend. Niranjan Hiranandani, National President, National Real Estate Development Council (NAREDCO

) is cautious in his response when asked to comment on this. “In theory, any cooperative housing society can follow the self-redevelopment option. But the limited numbers so far would suggest that it is not an easy task,” he says. “This involves permissions and clearances, and delays which can be frustrating. On the other hand, a real estate developer knows the ropes, understands the challenges and gets problems sorted out – so the residents do not have to deal with the difficulties and challenges, if they opt for a developer. So, in theory it is perfectly ‘do-able’, but in actual practice it is not as easy as it would seem to be.”

Hiranandani adds that “for developers who are also into redevelopment, the challenge is for original residents to be realistic while working on the parameters of the project – and not adding demands as the project moves ahead. In most cases where things have come to a halt, it usually is because existing residents want a bit more than what the norms specify, and often come up with non-negotiable points. If these impact the fiscal viability of the project, the developer is usually caught in a bind. This then results in work grinding to a halt – at times, for a very long time.”

Residents of Ajitkumar Society in Goregaon will soon be able to move into their nine-storey building which is almost complete, six months ahead of schedule. With the additional FSI they have gained from self-redevelopment, they will get larger apartments and additional flats to sell in the open market to pay off the loan taken from MDCC bank